who is exempt from oregon wbf

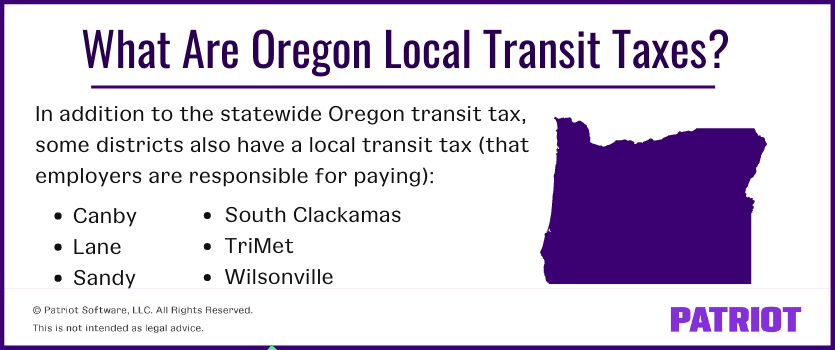

For purposes of the transit district payroll taxes certain payrolls are. If your business is not required to carry workers compensation coverage you are exempt from the WBF Assessment.

Oregon Payroll Tax And Registration Guide Peo Guide

Go to Employees then Employee Center.

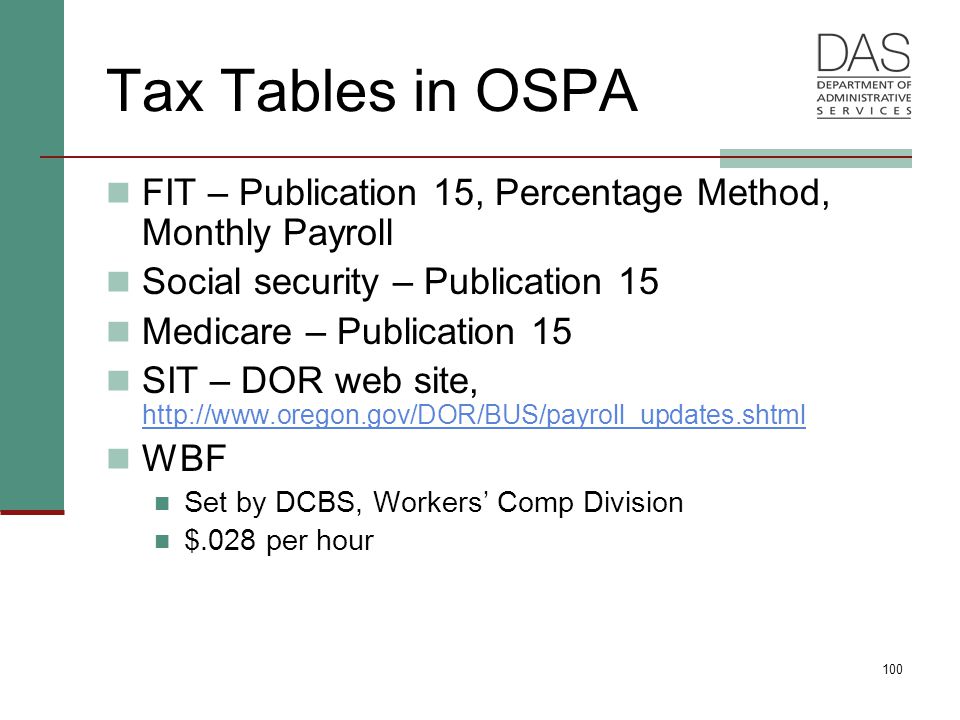

. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Select the Other tab. If your business is not required to carry workers compensation coverage you are exempt from the WBF Assessment.

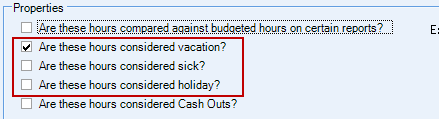

May 21 2019 358 pm. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation. For Oregon Benefit Fund choose Exempt How is.

Tel 541-737-9600 FAX 541-737-8082. Oregon employers employee who is injured while working permanently outside Oregon is not subject worker. Rule 150-267-0020Wages Exempt From Transit Payroll Tax.

Temporary total disability benefits. Select Taxes to display the Federal State and Other tabs. Who is exempt from oregon wbf.

The DOR is developing a new state. Because the Oregon minimum wage increased to 690 on January 1 2003 the new minimum weekly salary requirement is 276. Double-click the employees name.

SAIF 212 Or App 627 159 P3d 379 2007 Sup Ct review denied. Oregon Workers Benefit Fund. Help with workers compensation insurance Workers Compensation Division 888-877-5670 toll-free 503-947-7815 wcdemployerinfodcbsoregongov.

The Workers Benefit Fund WBF assessment this is a payroll assessment. The oregon state state tax calculator is updated to include the latest state tax rates for 20212022 tax year and will be. To mark your business as exempt.

Currently under federal law if the minimum salary of. Wages Exempt From Transit Payroll Tax. Office of Institutional Research Oregon State university 500 kerr administration Building Corvallis OR 97331-8572.

Payroll Settings Payroll Settings.

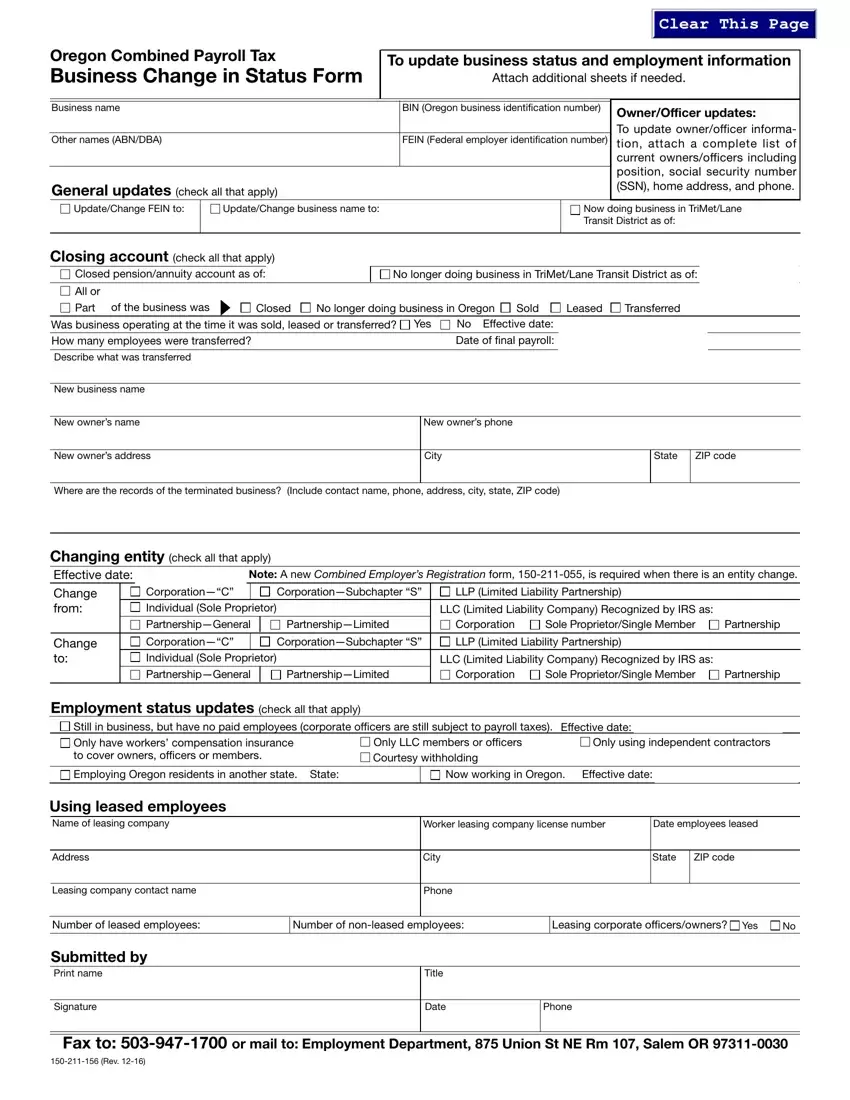

Oregon Combined Payroll Tax Report Pdf Free Download

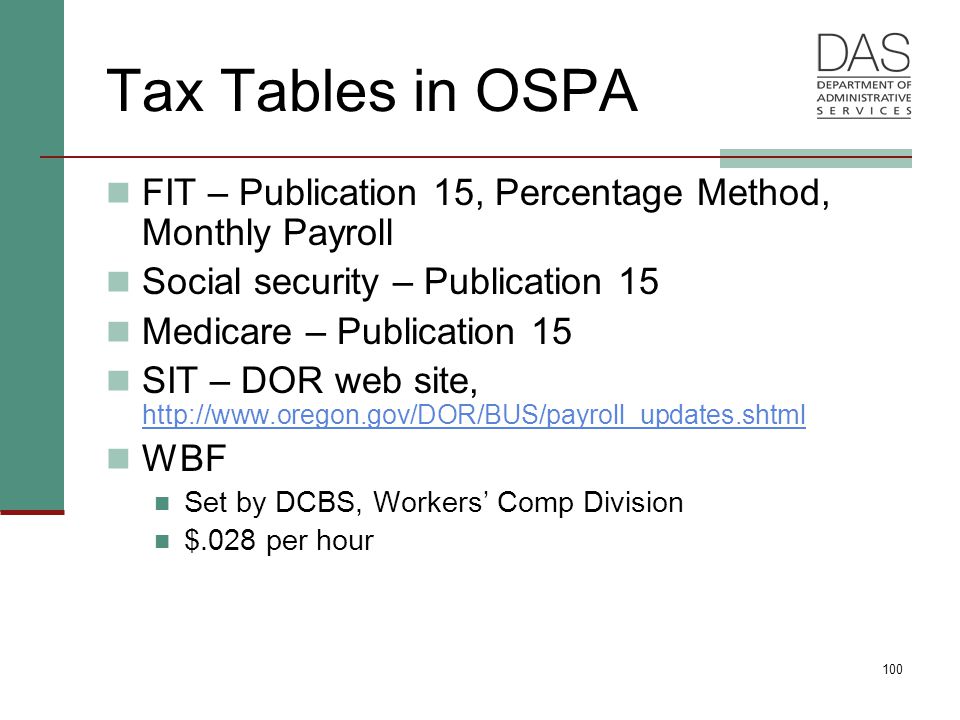

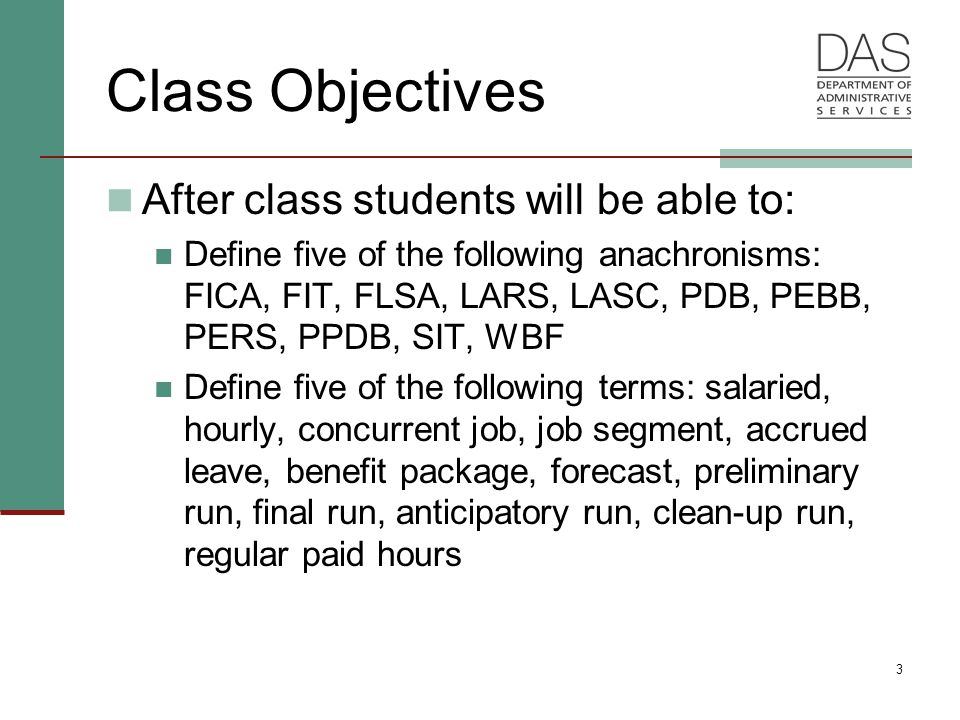

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Payroll Tax And Registration Guide Peo Guide

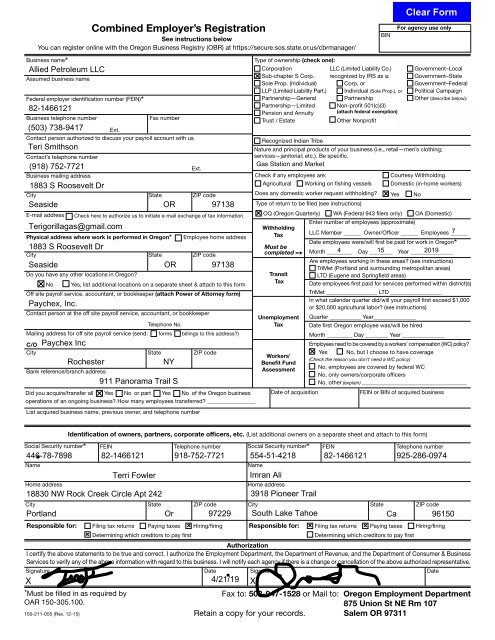

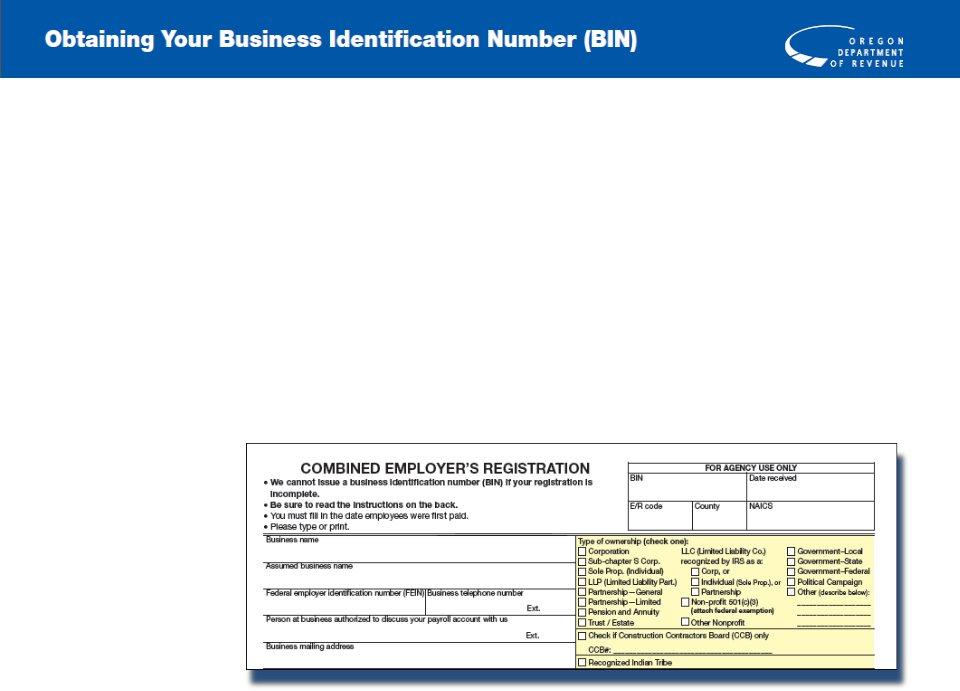

Form 150 211 055 Combined Employer S Registration

Construction In Process Tax Exemption For Oregon Businesses

Form 150 211 055 Combined Employer S Registration

Bin Oregon Fill Out Printable Pdf Forms Online

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Bin Oregon Fill Out Printable Pdf Forms Online

What Is The Oregon Transit Tax Statewide Local

Oregon Workers Benefit Fund Payroll Tax

![]()

Oregon Bill Exempts Amateur Athletes From Comp Coverage Business Insurance

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Workers Compensation Claim Fill Out Sign Online Dochub

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Payroll Tax And Registration Guide Peo Guide

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download